Moneydance Personal Finance Manager For Mac

How We Chose the Best Personal Finance Software Security If we’re handing over bank accounts, credit card numbers, and the rest of our financial information to a company, we need to be sure it’s taking strict security measures to keep that intel protected. So we scrutinized privacy policies and compared security claims. First, we cut any finance app without an “https” domain name. That’s the secure version of http — it uses encryption to prevent any third-party interception while you’re accessing the web. This is especially important for (and even more so when you’re logging into your bank).

Then, we dug into the fine print. All of our top picks use 128- or 256-bit encryption and TLS 1.2 for transmissions — the most up-to-date protections on the web. These ensure that your data can’t be hacked or stolen while it’s in transit. Account Xpress, AceMoney, Budget Express, Home Bookkeeping, Monefy, Moneydance, Moneyline, Pocket Expense, RichOrPoor, Spending Tracker, SplashMoney Multi-factor authentication We also gave preference to personal finance apps that use multi-factor authentication. That includes any step beyond just entering a username and password, like receiving a secret code through text or email. Confirming your identity through another device or channel ensures that you’re really you, and not some hacker who got ahold of the account info.

Our top picks all require text- or call-based verification both when you set up your account and start using it on a new device. Access on mobile and desktop We made sure that all of our top picks offer mobile apps for both iPhone and Android, so you can check in and manage your finances on the fly — say goodbye to anxious mental math before picking up that next round of drinks. We also cut finance apps that only operate on mobile, without the option to use a desktop or web app.

Mobile accounting is super convenient, sure, but a computer affords the space to see all your information laid out on one screen. This makes it easier to multitask — like keeping an eye on your debts and spending trends while you allocate funds to a budget. Dollarbird, Goodbudget, GnuCash, Handwallet, Fortora Fresh Finance, Money Lover Customer support It’s likely that at some point down the road you’ll have questions: Why won’t my retirement account sync to my software? How do I set a long-term savings goal? Something looks funny; what’s going on with these numbers? Many of these can be answered through tutorials and FAQs, but finances are complex and really personal; sometimes there’s no substitute for an actual human helping you out.

So we called, messaged, and emailed customer support to find the most reliably helpful software companies out there. The best software should offer personalized feedback in case you’re struggling with an issue that’s not covered.

Mobilis Personal Finances, Wallet (BudgetBakers) Ease of use The only thing left to do was to get up close and personal with our own finances. We set up accounts with our five front-runners, downloaded every app, and then got to work hooking up our bank accounts, tinkering with settings, tracking our finances, and building budgets. We logged in every day for a month, checking to make sure transactions were imported properly, monitoring our spending trends, and seeing whether they helped us stick to our budgets with prompts and warnings. Overall, we were pleased with our top contenders. We found that all of them — except one — were intuitive, well-laid out, and easy to learn.

Why we chose it Account setup If you’re totally new to money management, Mint is the way to go. The simplicity starts with account setup. Mint links all your accounts with the same bank in one fell swoop, so it only takes a minute to get rolling. Then it pulls two months’ worth of transaction history and begins categorizing. Transaction sorting This is where we were really impressed: Intuit’s products (the other being Quicken) nail down transactions better than any other software we looked at.

They even break down subcategories (think: “Fast Food” instead of “Restaurants”). Mint (left) labels every transaction clearly while Personal Capital (right) uses general categories. Visualizes spending Understanding categories helps Mint make sense of your budget trends — which means that you can, too. It uses a unique pie chart system to show you how income and expenses break down: You can adjust these charts to show spending for specific categories, accounts, or time periods. This is a level of financial visibility we didn’t see anywhere else. It gives you deep insight into your own habits so you can check in and make adjustments if need be. Mint automatically visualizes your spending habits, so you can see where your money’s going at a glance.

Budgets feature Mint allows you to create budgets for a number of categories. Start with the preset budgets, like ”Restaurants” and “Transportation,” or create as many custom categories as you like. The software will automatically fill them in, but we noticed that it’s not as smart about labeling budgets as it is with transactions. (It slotted a bus pass into “Education,” for example).

You may have to do a little tinkering initially to set it straight. Why we chose it Ad-free Quicken is made by Intuit, the same parent company as Mint. It feels similar, with an equally user-friendly interface and tools, only minus the distracting credit card and loan ads.

Desktop app Along with being ad-free, Quicken is a bit more robust than Mint. It uses a downloadable desktop app rather than a browser-based one, which has some perks. For instance you can build out a calendar to track budgets, bills, and savings over time.

To stay up-to-date with this calendar, the app lets you create customizable pop-up alerts for your desktop. It also has extra Report and Summary options — like “Net Worth Over Time,” “Spending Over Time,” and “Tax Summary” — that might be helpful for people with more accounts and assets. Quicken tracks your budgets, bills, and expenses in a customizable desktop calendar.

Good for managing large portfolios We recommend this home budget software for people who are familiar with managing their finances and won’t need any hand-holding (like Mint’s suggestion boxes). Quicken is also a good choice if you have multiple accounts or larger assets to keep track of: Its desktop app is well suited to managing a more built-out financial portfolio. Points to consider Customer support All of Quicken’s communication channels had lengthy wait times (30+ minutes) with no indication of where we were in the queue. Of course, they assured us that we could get shorter wait times by upgrading to ‘Premium Support’ for an extra $50.

Quicken does have a really comprehensive Support section on its site to help you troubleshoot. And if you have any experience with money management, the software is intuitive enough that you may not have many questions.

But we were still disappointed by its weak live support. Price Quicken will cost you between $35 and $90 annually, depending on your operating system. If you’re on the fence about taking that leap, Quicken offers a 30-day money-back guarantee, so you can take the software for a spin and see if Intuit’s tools work for you. Mobile app Quicken’s mobile app leaves a lot to be desired. It has a dismal 1.7 rating on 1,424 reviews in the App Store, and 2.8 on 2,475 reviews in Google Play. Most users complain about the app being painfully slow — a real problem if you’re at the store trying to figure out if something is within your budget.

Why we chose it Budgeting feature If you have trouble making a budget and sticking to it, then you need You Need A Budget (it’s redundant, but true). This software takes a unique approach to budgeting. Instead of making a hypothetical plan for future money, YNAB works with the cash you have on-hand.

It asks you to allocate all of your income: First, cover your immediate expenses; then, once those are taken care of, money goes towards next month’s expenses and savings goals. There’s no discretionary cash left sitting around — which means you won’t be tempted to spend it frivolously. Instead, every dollar is put toward a specific purpose, which is what YNAB means by its first rule: “Give every dollar a job.”. Thoughtful account setup YNAB had us import each account separately, as opposed to pulling everything at once like Mint did. This took a little longer, but it made us think critically about how we wanted to prioritize our finances.

For example, when we imported a credit card, YNAB asked us how we’d like to pay it off and then helped us work that goal into our budget. This setup process lays the foundation for thoughtful money management from day one.

Helpful tutorials YNAB also walks you through budget planning with plainly-worded, helpful tutorials. To really succeed though, you need to take the before anything else. Trust us on this. We tried crafting a budget without it and were a little lost: What was Age of Money? What were Immediate Obligations and True Expenses and how were they different? Why was YNAB saying we’d overspent when we still had cash?

Then we took the webinar, and everything clicked. Beyond the Get Started intro, YNAB also offers live courses on Breaking the Paycheck to Paycheck Cycle, Budgeting when Money’s Tight, Paying for Big Expenses without Borrowing, and more. These awesome resources take YNAB from a budgeting platform to a one-stop-shop for becoming financially responsible. Flexible goals One thing we really appreciate is YNAB’s flexibility. The company’s “roll with the punches” philosophy reflects the way we handle money in real life. Maybe you get a pricey Uber and overspend on your Transportation budget. No problem — you can log in, redirect some of your dining out budget to cover it, and you’re home cooking (affordable) dinners in the black.

Our other top picks didn’t make it as easy to reset our goals and stay on track. YNAB has tons of budget categories. You can choose which ones to use based on your individual financial needs.

Points to consider More prescriptive than other apps We’ll admit that YNAB isn’t 100% flexible across the board. It only asks you to budget for non-immediate expenses like “dining out” after you’ve fulfilled all your “immediate obligations.” This is a sterner approach, and may feel more prescriptive than our other top picks. But YNAB’s honesty about priorities is part of what makes the software so successful. Fewer analytical tools Compared to our other top picks, YNAB is a bit of a one-trick pony. Everything relates back to your budget: Income, expenses, and goals are all presented in terms of dollars allocated and dollars to be allocated. This is great for keeping you on track, but it also means that YNAB lacks the trend graphics and other analytical lenses we loved from Mint, Quicken, and Personal Capital.

Successful money management will hinge on whether YNAB’s specific lens works for you. Why we chose it Great for people with irregular cash flow Personal Capital lets you monitor your finances without getting too entrenched in day-to-day balance changes.

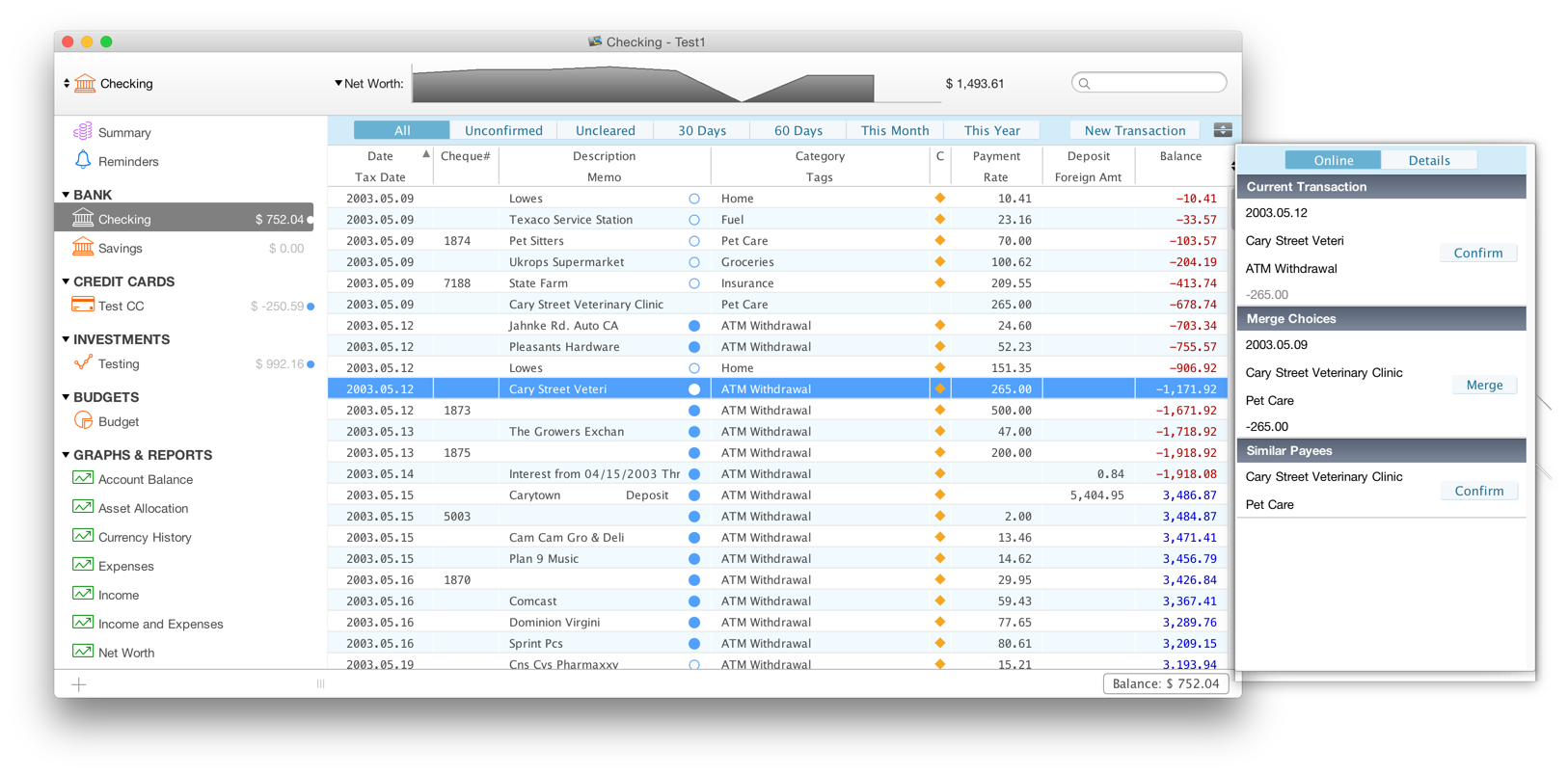

Moneydance Software

If you have unpredictable paychecks, for instance, it might not make sense to stick to a set monthly budget like YNAB’s. Or maybe you have unusual spending habits, like frequent business travel. In that case, using a transaction-focused software like Mint may not be particularly useful. Personal Capital offers a little more flexibility. It won’t send alarmist notifications if your accounts see a substantial change from one day to the next — as long as your net worth doesn’t suddenly bottom out. Bird’s-eye view of finances This big-picture outlook is represented beautifully on Personal Capital’s interface.

The first thing you see after logging in is your net worth, represented in a calming blue graph. Your overall cash value is clear at a glance, and you’ll know right away whether your worth is trending upwards or down. You also have immediate access to income and spending trends: You can see, on a monthly basis, what categories the majority of your transactions fall into. This gives you a good idea of where your money is going, and if you need to make any high-level adjustments to your spending patterns. Cash Flow (otherwise known as ‘cash on hand’) is shown just above so you know how much money is available to you at any given time. Investment tracking We loved how Personal Capital’s homepage tells you — both in real dollars and percentages — exactly how much your 401(k) or other investment holdings have gone up or down. It also lets you know whether the Dow Jones, the S&P 500, and other major indices have earned or lost value, so you can keep track of the markets as you monitor your own investments.

Automatically imports transaction history Personal Capital made getting started incredibly easy by importing four months’ worth of transactions right off the bat — twice as many as Mint. That means we had immediate access to a substantial history of spending and savings trends.

We didn’t have to use it for months to get a clear picture of our finances. Points to consider Vague transaction categories Unfortunately, Personal Capital doesn’t categorize those transactions as well as Intuit or YNAB. Expenses are slotted into general categories (e.g. “Transfers” instead of “Rent & Mortgage”), and the way they’re listed doesn’t show the transaction location at a glance. This makes sense with Personal Capital’s macro-view outlook; just note that if you want to keep a close eye on transactions, this software will be frustrating. Minimal guidance Personal Capital’s interface feels like it’s saying, “Hey, here’s what you have.

Do with it what you will.” By comparison, the first things you see with Intuit software and YNAB are account balances, upcoming bills, and budgets. They feel a little more rigid — like an advisor counseling you about what you should be doing with your finances. Because it’s less focused on individual transactions and budgeting, we recommend Personal Capital for people who are already pretty financially savvy. This software will keep you in the loop about your finances without being overly prescriptive. 'What makes a personal finance software successful isn't just the app's features; it's how dedicated you are to using the app in order to reach your financial goals.'

Duren Personal Finance Specialist HighYa.com It comes down to checking in often, paying attention to trends, sticking to your budgets, and making adjustments when things don’t go quite right. You’ll only be motivated to put in the work if you actually like using your software, so picking the right one is an important first step. Set goals Before starting with a personal finance software, have an honest conversation with yourself about why you need it. Maybe you’re starting your first salaried job, and you want to learn to use your paychecks wisely. Maybe you have a hard time staying within your grocery budget.

Maybe you want to save for a car or a house, but don’t know where to start. “The most important thing is to know where you are weak and strong in your finances and then look for an app that strengthens those weaknesses and augments those strengths,” Duren told us. Test free trials If you’re not sure what features you need out of a personal finance app, then we recommend trying a couple out before committing to one. All of our top picks are either free or offer a free trial, so you can take them for a test drive and see which tools work for you. Technical vs fundamental analysis forex metatrader 4 for mac. Schedule a “money date” Don’t have time to check in on your finances daily?

“Make a Money Date with yourself every week or every month,” suggests Meka West, founder and CEO of. Make sure your transactions are categorized appropriately; check your spending against your budget; and see if you want to change any of your spending or saving habits before the next Money Date. Whether daily or monthly, the most important thing is that you stick with it. Focus on developing good habits Remember: You don’t have to use every single feature. For example, Mint will prompt you to set long-term savings goals — but if that doesn’t inspire you, you can always just use its tracking charts to make sure you’re staying on track with your day-to-day financial needs. “With any new software, you have to dip your feet in and slowly immerse yourself in the features,” says West.

“It kind of starts to come together after a month.” That may sound slow-going, but think of it like working out or healthy eating: You have to put in the effort and stick to your plan, but eventually you’ll see big results. Personal Finance Software FAQ What is the 50/30/20 budget? The 50/30/20 budget is a way to break down your expenses: 50% should go towards needs like groceries, housing, and car payments, 30% on wants like eating out, shopping, or events, and 20% should be saved. How much of your income should you save?

Most experts recommend devoting around 20% of your income to savings. That includes retirement accounts like 401ks and Roth IRAs, which are taken directly out of each paycheck. While this varies from person to person — an 18-year-old working their first job probably won’t have the same saving habits as someone near retirement — it’s still a good benchmark to aim for. How much of your income should you spend on housing? You should aim to spend about 25% of your pre-tax income on rent or your mortgage. While that might not sound like much, keep in mind that you’ll likely still have to factor in additional expenses like utilities, TV and internet service, and possibly renters or homeowners insurance. What is personal finance software?

Personal finance software gives you a (cheap or free) personal accountant wherever you go. It can help you set and stick to a budget, track what you’re spending your money on, and give you advice on how you can reach your financial goals. Advertisement Disclosure has an advertising relationship with some of the offers included on this page. However, the rankings and listings of our reviews, tools and all other content are based on objective analysis.

For more information, please check out our full. Strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website.

All products are presented without warranty.

Updated September 13, 2018 We are committed to researching, testing, and recommending the best products. We may receive commissions from purchases made after visiting links within our content. Learn more about our. Personal finance software can help you master the basics, become more efficient at managing your money, and even help you discover ways to meet your long-term financial goals. Choosing the best personal finance software is based on your current financial needs. Some personal finance software can help you master budgeting and expense tracking while others can help with investment portfolio management.

Of course, your budget for personal finance software matters, too. Our list of the best personal finance software includes free and paid options to suit a variety of financial goals. So take a look before and get your finances in order in no time. Courtesy of Quicken Having been around for several decades, Quicken is one of the most established of all the personal finance software on the market. You can use the software to manage various aspects of your financial life from budget creation to debt tracking, savings goals, and even investment coaching. The software features Excel exporting, which allows you to manipulate and perform additional calculations on your data. Some of the more advanced features include bill paying, which allows you to set up payments for your bills right from the software.

You can even use it to track the value of your assets to have an accurate calculation of your total net worth. The app is robust enough to manage both your personal and business expenses and even handles property management functions like rental payments from tenants. The software starts at $34.99 and is available for Windows, MacOS, iOS, and Android. Courtesy of Mint Mint is one of the most popular budgeting and expense tracking tools. You can have the software pull in your bank and credit card information to analyze your spending and pinpoint areas that you can cut back on spending to improve your finances. For more accountability, Mint allows you to set up alerts for things like due dates and low balance to keep you on track.

These features help you avoid expensive fees for late payments and overdrafting your bank account. If you’ve set up budget categories, Mint will give you real-time information on the amount you can spend on things like food and gas. Courtesy of YNAB You Need a Budget, YNAB, is a personal finance software that’s aimed to help you improve your financial literacy as you manage your monthly budget.

As you create your budget and manage your daily finances, the software provides you with tutorials that will help you tackle some of the tougher financial topics. If you’ve been struggling with bad financial habits, YNAB can help you break those by helping you stick to a few basic financial management rules.

The software automatically links to your bank account, bringing in your spending information for analysis and budgeting tracking. You can keep tabs on how you’re tracking towards your monthly budget and take action if you’re overspending.

Moneydance Personal Finance Manager For Mac Os

It doesn’t include any investment tracking capabilities. YNAB offers a free trial that allows you to use the software while you decide whether it’s right for your personal finance goals. The full software is $6.99 per month ($83.99 per year). Courtesy of Mvelopes The traditional envelope budgeting system helps you stick to a budget by using envelopes to manage your budget. Once you’ve figured out your budget, you put that amount of cash into a budget. So, if you budget $100 for gas for the week, you place that amount in an envelope and once you’ve spent $100, that’s it. Mvelope takes the same approach to budgeting, except that it’s done digitally rather than with physical cash.

Choose the financial goals that are most important to you, then add your bank accounts and set your income. Mvelopes will help you create a budget and set up your “envelopes.” The software tracks your spending and shows what you’ve spent from each envelope to keep you on budget throughout the month. There are several different versions to choose from (one of the versions is free) with some of the higher-priced options providing additional features and coaching options. Courtesy of TurboTax You may not necessarily need TurboTax to manage your finances throughout the entire year, but when it’s tax time, the software can come in handy. While it’s one of the pricier tax preparation tools, it’s also consumer-friendly, walking you through your tax preparation to help you accurately prepare your taxes. Entering your tax information is fairly simple – you can import your W-2 information from your employer or take a picture of the form and the software will transfer the information into the form.

If you’ve used TurboTax in previous years, the software will remember much about your personal information and ask whether there have been any major changes. There’s a free version if you only need to file a Federal 1040EZ or 1040A. On the higher end, TurboTax Live connects you with a CPA or Enrolled Agent to give you personalized advice and answer questions about your tax return. Paid versions of TurboTax include a feature to help you maximize your deductions by uncovering deductions you may not have known were available to you. Courtesy of FutureAdvisor If you’re a DIY investor looking for low-cost access to a financial advisor, FutureAdvisor is a great option.

Best Personal Finance For Mac

The investment software provides free personalized recommendations to help you diversify your portfolio, which you can follow or not follow as you see fit. There’s a paid robo-advisor version that gives you more comprehensive portfolio management on accounts held at Fidelity or TD Ameritrade. In case you’ve never heard of it, a robo-advisor is an automated investment advisor that can analyze your portfolio based on advanced algorithms.

If you’re looking to make more tax-efficient investment choices, the cost of the robo-advisor may be worth it. The paid version of the software requires a minimum balance of $10,000 and charges a 0.50 percent management fee.

Courtesy of Personal Capital Personal Capital allows you to manage all your financial accounts in a single platform. You can include your bank accounts, mortgage and other credit accounts, plus your investment accounts to have your complete financial picture right in front of you.

If you have multiple accounts – as most of us do these days – using Personal Capital can save you from having to switch between multiple screens to understand where you stand. If you have a portfolio of more than $100,000, you can get personalized financial advice based on your goals.